THE MARKETS ARE NOT FIGHTING THE FED, BUT LEADING IT…

John Lui

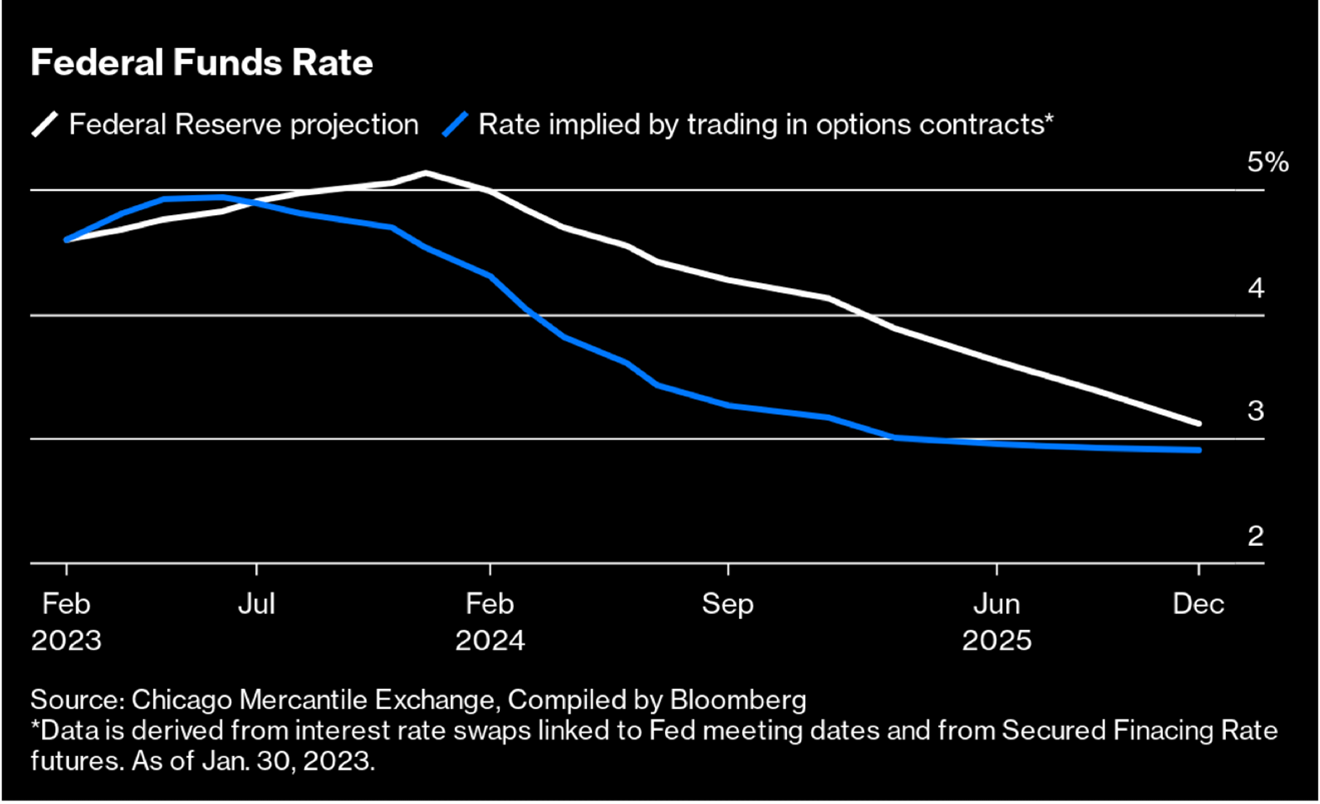

The above chart of the Federal Funds Rate shows that by December 2025, the market (blue line) and the Federal Reserve (white line) both agree that the Federal Funds Rate will be around 3%. Both agree that interest rates have peaked and will be cut by the Federal Reserve in the near future.

Just as the market led the Federal Reserve in the interest rate up cycle, as inflation and interest rates climbed, the market is again leading the Federal Reserve as to when inflation and interest rates peak and decline. You can see the market (blue line) leads the Federal Reserve (white line).

Note that there are minimal differences between the market and the Fed as to:

What level interest rates peak

When interest rates are cut

After a huge run up in interest rates from near zero, we are very near the peak in interest rates. It is not in the interest of individuals investing for retirement to time and trade the market when we are so close to peak interest rates. What is the big difference if interest rates peak after another 0.50% or 0.75%? Should someone really care if they lock in a 30 year fixed mortgage at 3% instead of 2.75% or 2.50% as mortgage rates reached decade lows?

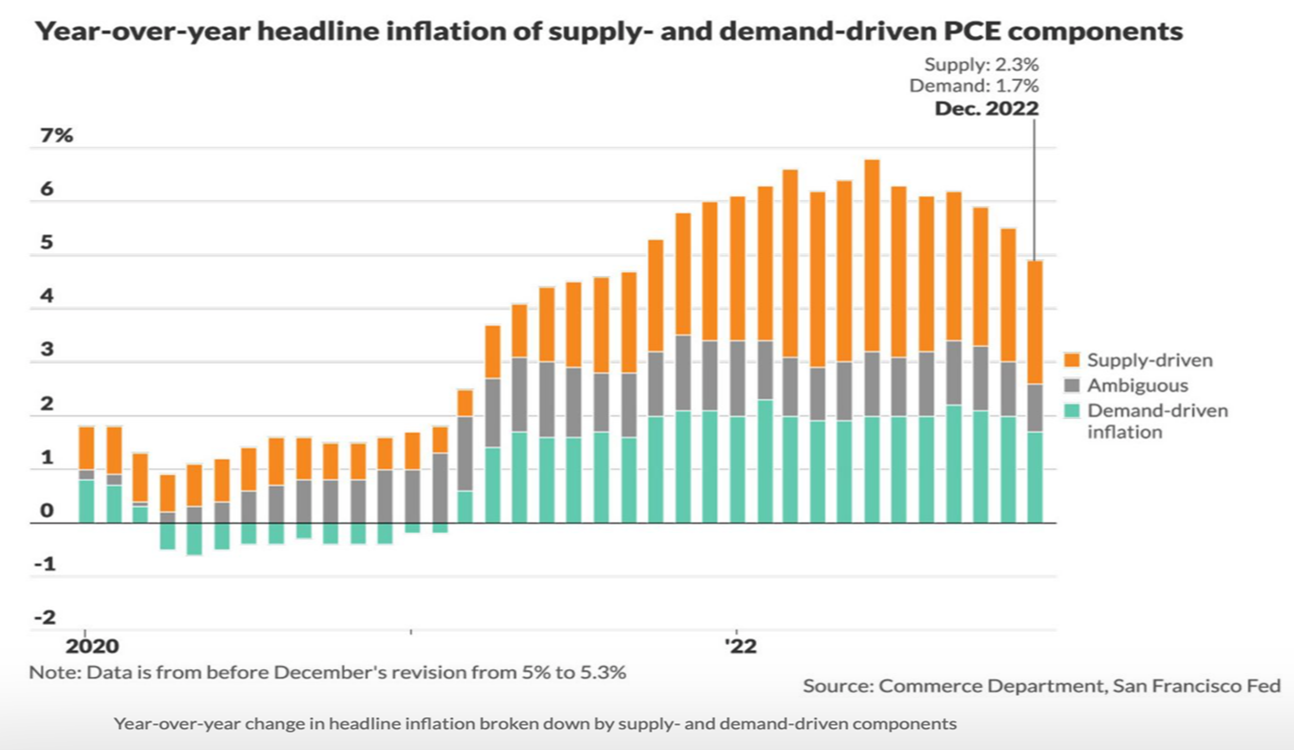

As with when interest rates are cut by the Fed, the market is again leading the Fed, as investors are using leading indicators of inflation while the Fed is using lagging indicators of inflation. Below is a chart from the San Francisco Fed that shows inflation has peaked and rolling over. We can expect rates cuts by the Fed sooner rather than later.

Please call us if you want to discuss any of your investment concerns.