“The secret of getting ahead is getting started”. Mark Twain

By Brian McGeough, CFP® and Senior Relationship Manager

CWM Shutterstock

Getting started on financial planning can be a daunting task. Nobody wants to spend time collecting information about their living expenses, their income opportunities or some large expenses they will have some time in the future (college, wedding, etc). Not only is it a boring chore, but many people just don’t want to know or think about how much money they spend! Financial planning can mean different things to different people. For some people it is about meeting their short-term needs while also saving for their long-term goals. For someone in mid-life it could be about income replacement as they move toward retirement. And for someone later in life, it could be about estate planning and dispositions of assets. No matter the stage of life one is in, it is never too early or too late to start the financial planning process.

Below are some benefits of financial planning:

1. Holistic view of your financial life

Many people have multiple assets including their homes, investment accounts, life insurance products, pensions…. the list of assets that an individual owns can be quite large. However, most people never list all those assets in one place. The full view of your assets can help answer questions like how much I should be spending, saving and investing. Also, it helps to determine which assets could be working better to help you achieve your goals.

2. Make your next financial move with confidence

Having expenses, income, and goals laid out in a single document can give a great level of certainty when it comes time to making that next big financial decision. If buying a second home is a goal, what is affordable, what are the ongoing expenses and which accounts will the money come from are some of the things to consider. It is easy to add that goal to the existing plan and see what the impact will be on the probability of a successful retirement if that new goal is added. Buying a second home should be an exciting time, but putting your self in a financial bind is very stressful. Financial planning can help analyze what you can afford and how the decision will impact your probability of a successful retirement.

3. Create a roadmap for the disposition of assets

Estate planning is a key part of financial planning. What is the best way to leave the most amount of your assets to your heirs or charities? Starting this process early helps to avoid trying to play catch-up. Waiting too long to start this process may limit your options as you get older.

4. Sleep better at night

Spending the time to develop, implement, monitor and update a financial plan can help keep perspective during volatile markets. The ability to revert to a plan during market disruptions is key to helping make sound financial decisions during turbulent times. Making investment mistakes at the wrong time in the market can have a detrimental impact you your long-term financial health.

5. Uncover opportunities and risks

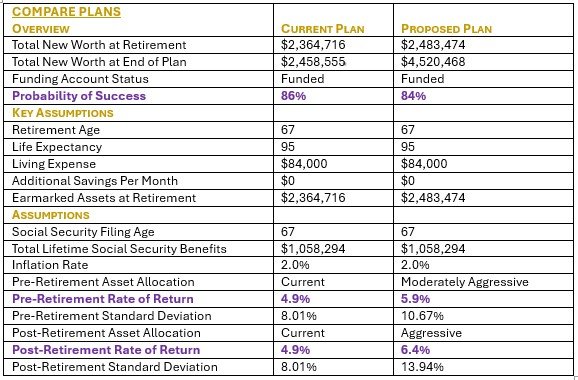

Having all your assets listed in one document may reveal some risks that might not be obvious. A portfolio can contain multiple assets that are highly correlated, so an economic event may cause many assets to lose value simultaneously. Also, having a portfolio with a high growth rate is something that many people want, but with this higher growth comes higher risk and volatility. Financial plans include estimates of what the investments in the portfolio will produce as well as a risk metric over time. If the plan works for a given return estimate, is it worth the extra risk to strive for higher returns? Many times, a plan with a higher return estimate will have a lower probability of success than the lower return because of the increased risk. The table below compares two financial plans. The plan on the left has a lower pre and post-retirement growth rate but also has a higher probability of a successful retirement due to the lower risk estimate in the portfolio.

Source: CWM Orion Planning/Sample

No matter the stage of life someone is in, it is always a good idea to have an inventory of your assets and how they are working toward your financial goals.

At Chatham Wealth Management, planning for the future is one of the core ways in which we work! Please be in touch so we can update your plan and work with you to address the many possibilities and eventualities that may come your way. Reach out to us via email at info@chathamwealth.com or call our office!

Disclosure

Chatham Wealth Management is registered as an investment adviser with the SEC. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser has attained a particular level of skill or ability.

Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable for a client's portfolio.