This Cool Investing Feature Is the Key to Reaching Your Goals

CWM Shutterstock

What you'll learn

Why you should be thinking about "future you" today

Why being young is actually your biggest advantage as an investor

How compound growth can boost your savings

When you're young, it can feel like there's a whole list of things you can't do yet.

But did you know that right now—is actually the best time to start saving for your financial future?

You might be thinking, My financial future?? But I haven't even graduated from high school or college yet!

Well, that's sort of the point. The younger you are, the more time your money has to benefit from something called compound growth. But only if you invest it.

Compound growth: it's growth on top of growth

When you invest money, you're buying stocks, bonds, or other things that you think will be worth more money over time. Picking your investments might seem overwhelming, but it doesn't have to be complicated. You can choose individual investments if you want to, or you can go with something called a fund, which is a single investment that holds multiple investments within it.

When your investments make money, the result is called an investment gain, which is the difference between what you paid and what the investment is worth today. (An investment loss is the opposite: when an investment you own is worth less today than what you paid.)

If you keep those gains invested—in addition to your original money—you can potentially see your gains earn gains, too. By reinvesting those gains again and again, the process keeps repeating itself, and it can add up fast. This is the beauty of compound growth.

And remember how we said that being young is awesome for investing?

Your age is your superpower when it comes to compound growth. Even if you start with small amounts now, your money can increase exponentially if you leave it invested long enough.

Confused a little? Let's clear things up with an example.

Starting early for the win

This is the story of two investors, Maria and Anna.

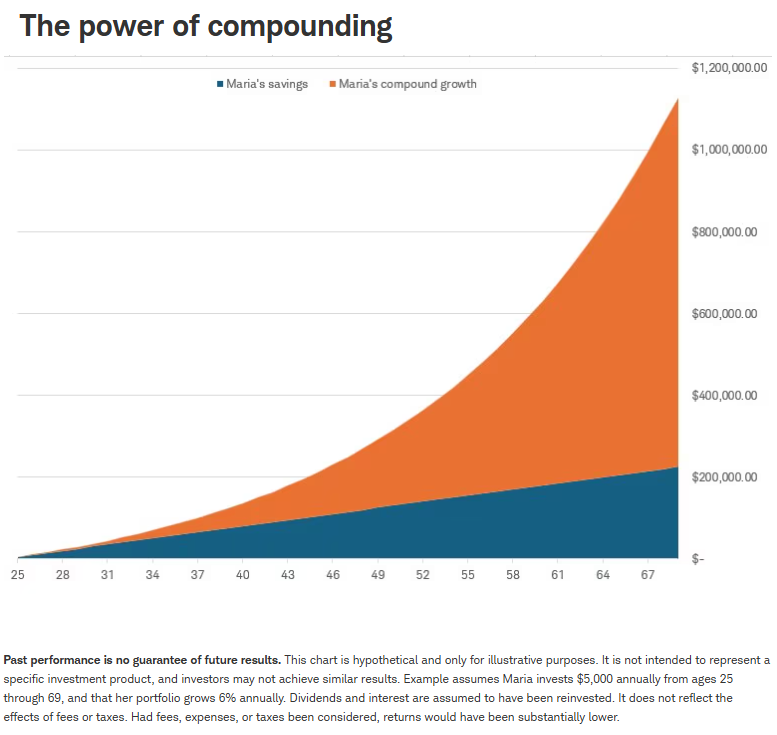

Maria started saving for retirement at age 25 when she got her first job. She was consistent with her contributions, adding $5,000 each and every year until age 70—saving a total of $225,000.

Anna, on the other hand, had a lot of credit card debt and some student loans to pay off, so she didn't start saving until she was 45. To try to catch up, she decided to save $10,000 a year. By age 70, she saved $250,000—$25,000 more than Maria.

Now, assuming their savings both grew by 6% each year, who do you think had more money when they turned 70?

Spoiler: It was Maria!

Even though she contributed less total money, Maria's investment balance at age 70 was $1,127,540, compared to Anna's $581,564. That's almost twice as much.

While that doesn't seem possible, it is! By starting early, Maria's money had 20 extra years for compound growth to work its magic.

Time = money

Still not convinced?

Here's a look at Maria's savings, broken down by her own contributions versus the growth those contributions earned over time.

Start now!

We're big believers that it's never too soon to start thinking about your financial future. Because the earlier you get going, the more likely it is that you will reach your financial goals.

Your next steps

Think of a goal you have—like saving $5,000 for college in five years—and figure out how much you need to save versus earn to reach it using the Compound Savings Calculator.

If you're working and earning a paycheck, consider saving something toward retirement each month—even if it's just a couple bucks.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Source: Charles Schwab, published July 9, 2025: https://www.schwabmoneywise.com/teen/story/investing-feature-key-to-goals